Disclaimer: Cryptocurrencies are speculative, sophisticated and include important challenges – They may be very volatile and delicate to secondary action. Performance is unpredictable and earlier overall performance is not any ensure of upcoming efficiency. Take into consideration your own personal instances, and procure your own private information, prior to relying on this information.

Curve Finance is an automated market maker (AMM) decentralized exchange protocol that swaps stablecoins with lower buying and selling expenses. Anyone can add their belongings to numerous liquidity pools as a result of this decentralized liquidity aggregator while earning a profit from costs in the method.

A pricing components is employed to find out the cost of belongings rather than an buy e book. Curve’s formulation is made generally to make swaps that occur in a considerably close array much easier.

Curve facilitates trading by utilizing the AMM protocol. Automated sector makers, or AMMs, use algorithms to cost tradable belongings in a very liquidity pool effectively.

The SWRV tokens had been dispersed in a liquidity mining occasion, exactly where everyone experienced exactly the same possibility to farm. Therefore, Swerve statements to get a a hundred% community-owned and governed fork of Curve.

Verification of seed. Confirm your seed phrase on another web page by deciding on the words and phrases in the right purchase. Once verification is entire, your copyright digital wallet might be able to go.

As well as swapping charges, CRV tokens are utilized to reward LPs who are supplying liquidity to certain pools. The distribution of these token APR (tAPR) rewards is governed by Group voting. Generate farmers actively find out these prospects.

Curve is usually a blockchain-based mostly process that aims to create investing less difficult without using a central get reserve. People can lock curve finance borrow stablecoins into lending pools and acquire CRV tokens in exchange for doing this in addition to obtain a share of your buying and selling fees.

In contrast, a centralized Trade using the “buy reserve” methodology will likely have a deep pool of assets in its custody if needed to supply liquidity for various investing pairs.

The protocol then sells DAI at a slight price reduction with regard to USDT to balance the USDT to DAI ratio. In this instance, volatility and impermanent decline are minimized since the protocol is working with stablecoins.

SushiSwap: a leading decentralized Trade designed on the Ethereum community in addition to a fork of a effectively-acknowledged DEX inside the DeFi space, copyright.

Find out how to save lots of on Ethereum fuel costs by using the Loopring decentralized Trade, and receive money to be a liquidity service provider.

Curve Finance is a decentralized exchange (DEX) on Ethereum that stands out from copyright as a consequence of its target liquidity pools made up of similar assets such as stablecoins, or wrapped variations of exactly the same variety of assets, like wBTC and tBTC.

Governance protocols allow for CRV holders to vote on conclusions involving the Curve Finance exchange. A holder's impact depends on the amount of CRV held and in addition on some time that the CRV has become held. Individuals holding CRV for that longest length of time keep the most pounds when voting.

Ralph Macchio Then & Now!

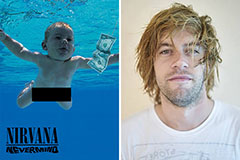

Ralph Macchio Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Brandy Then & Now!

Brandy Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now!